Market context and why OOH valuation is becoming important

Vietnam’s out of home (OOH) advertising market is entering a new growth phase. According to OIP, OOH spending is expected to grow by eight to ten percent each year, with the digital out of home (DOOH) segment forecast to expand the fastest thanks to rapid urbanization and high traffic flows in Hanoi and Ho Chi Minh City.

However, despite stable market growth, valuing OOH businesses in Vietnam often faces many challenges, especially when companies enter negotiations with foreign investors.

Valuation based on future economic value

A key characteristic of the industry is that most of a company’s value is determined by its ability to generate cash flow in the years ahead, rather than the number of assets on its balance sheet. Therefore, the primary valuation method remains the ability to generate future cash flow, in which investors forecast the profit a company can produce over the next three to seven years and then discount it to the present. This places emphasis on the sustainability of revenue, the quality of location lease contracts, and the performance of each advertising site.

For traditional OOH businesses without digital assets, growth expectations are often quite limited. Most international investors only value companies that own “golden point” locations such as key intersections, highways with heavy traffic, or major commercial areas. In developed markets, traditional OOH companies achieve only one to three percent annual growth if they do not expand their location portfolio. In Vietnam, this expectation is even lower due to intense competition and rising location lease costs.

The value of LED assets depends on measurement capability and revenue transparency

While traditional assets are constrained by low growth potential, digital assets such as LED screens are valued under a completely different logic. In the USA, the UK or Singapore, companies that own DOOH systems can be valued one to three times higher than static assets thanks to the ability to sell by time slots, control broadcast content, and precisely measure impressions.

However, for LED assets to be recognized at their true value, companies must demonstrate transparency and reliability in their operational data. Factors such as impression traffic measured by an independent system, automatically stored playback logs through CMS, stable screen uptime, and revenue broken down by campaign are basic criteria required by international investors. This is why major global companies such as JCDecaux, Clear Channel or Outfront Media comply with measurement standards from Geopath in the USA or Route in the UK. Such standardization enables investors to easily evaluate performance, and therefore pay a higher valuation.

In Vietnam, the gap between international valuation standards and local market practice remains significant. Many companies lack complete data for each advertising site, have not established location based measurement models, or do not have a sufficiently strong CMS to track real time revenue. This leads to inaccurate cash flow projections and forces investors to apply a higher risk discount.

The gap between international valuation standards and practice in Vietnam

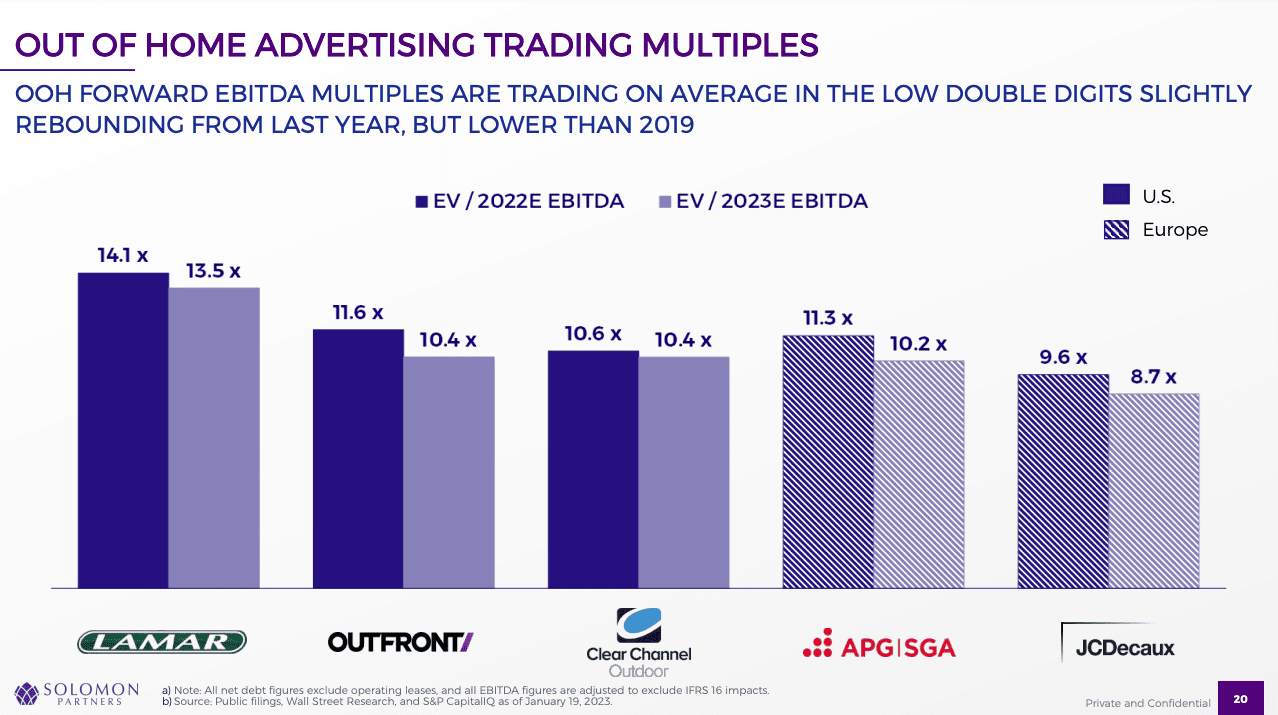

In recent M and A deals across Southeast Asia, OOH companies with transparent management systems often achieve EV to EBITDA multiples from six to nine times. In contrast, companies lacking detailed data are valued only at three to five times EBITDA, twenty five to forty percent lower than initial expectations. This is the result of not having revenue breakdowns for each asset, lacking information on operational performance, and not having internationally recognized revenue records.

The lack of data standardization also prolongs the due diligence process. In mature markets, OOH due diligence typically takes six to ten weeks. In Vietnam, many deals take three to six months as investors must verify every location lease contract, check the validity of permits, and reconcile actual revenue for each screen. When information is inconsistent or not fully traceable, legal risks increase, prompting investors to reduce their offer price or delay the transaction.

Impact on fundraising capability and business prospects

As regional competition intensifies, especially from funds in Singapore, Hong Kong and Japan, the ability to standardize data and upgrade measurement systems is becoming a mandatory requirement for OOH companies seeking international investment. Large funds tend to prioritize businesses with sound governance, real time asset performance monitoring, and clear expansion plans based on data rather than intuition.

In summary, the valuation of an OOH company today is not centered solely on tangible assets but on its capacity to generate future cash flow, the level of digitalization of its assets, and the transparency of operational data. Companies that meet these standards will gain a significant advantage in negotiations with investors, attract higher valuations, and shorten transaction timelines.

Tuan Anh – Nhu Phu, OIP (OOH Investment Partners)